Posted December 17, 2025

By Matt Insley

2026, Uncovered

[Today, we’re pleased to feature Emily Clancy who, for the past eight years, has helped shape Paradigm Pressroom's 5 Bullets as associate editor. Beyond the daily e-letter, she collaborates closely with the Paradigm Press network of analysts, ensuring you receive the insightful, relevant information you need to navigate the markets.

What follows is Emily’s first hand account from inside our recent Paradigm-wide meeting where big ideas were tested, challenged and sharpened for the year ahead.]

Last week in Baltimore, we put Paradigm’s best minds in one room with a single mission: Figure out what actually matters for investors in 2026.

Not the safe consensus calls. Not the recycled talking points. The real fault lines — the ideas that make people uncomfortable before they make money.

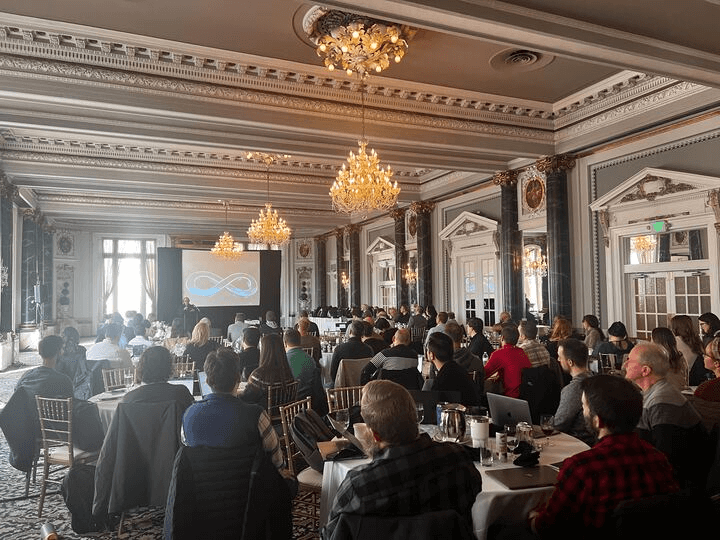

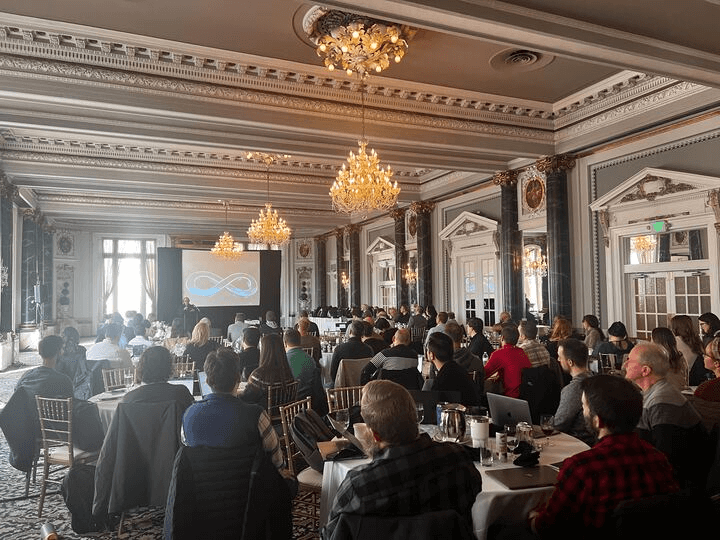

Paradigm’s team at the historic Belvedere Hotel in Baltimore (Dec. 11, 2025)

What followed was not a polite roundtable. It was a series of bold, sometimes unsettling forecasts that challenged almost every assumption Wall Street is leaning on today.

Here are three that stood out — and why they matter more than you might think…

Your Rundown for Wednesday, December 17, 2025...

Abundance, Crypto and Volatility Collide

Paradigm’s science-and-technology investor Ray Blanco flipped a familiar narrative on its head. Rather than focusing on collapse or crisis, Ray outlined a year defined by abundance.

One of his bravest calls: a renewed space race in 2026, what he describes as America’s next “Sputnik moment.” The driver this time isn’t nationalism, but infrastructure — specifically data centers moving into orbit.

Projects like Nvidia’s reported “Starcloud” concept are early examples of what Ray believes is coming next: orbital compute powered by continuous solar energy, reduced cooling costs and structural advantages that Earth-bound systems simply can’t match.

If it works, the implications ripple through AI, energy and national security.

Ray’s second prediction could be even more transformative. He’s tracking developments that point toward a functional cure for Type 1 diabetes. “Not treatment. Not management. A cure,” he emphasizes.

Ray is watching companies like Vertex (VRTX) and Sana Biotechnology (SANA) closely, with a preference for Sana’s “superior” approach, which aims to retrain the immune system rather than suppress it. If successful, the medical — and market — consequences would be profound.

The third pillar of Ray’s outlook is macro… and counterintuitive. He believes the economy is drifting toward deflation through abundance, not collapse. AI and robotics increase productivity. Reshoring and tariffs eventually stabilize supply chains.

Meanwhile, demographics quietly do the heavy lifting. An aging population, low birth rates and net-negative immigration reduce long-term demand across housing, health care and consumer goods.

Ray points to the Great Deflation of 1873–1896 as historical context — a period when prices fell for decades even as innovation accelerated and living standards improved.

The takeaway: Deflation doesn’t have to be destructive. Sometimes it’s the price of progress.

Chris Cimorelli, AKA Mr. 10X, zoomed out — then drilled down. His starting premise was simple: “Bitcoin is the best trade of the last century.”

But his real focus isn’t Bitcoin itself. It’s Bitcoin Cash (BCH) — a 2017 blockchain fork designed to preserve Bitcoin’s original purpose as peer-to-peer electronic cash. “Same 21 million cap,” Chris explains. “Same DNA. Different execution.”

Today, Bitcoin Cash hovers around $500 and sits just outside the crypto spotlight. Chris thinks that changes in 2026.

His thesis is that institutional investors — already stretched trying to gain meaningful crypto exposure — won’t be able to ignore BCH much longer. Especially if Bitcoin itself continues higher.

In his framework, a move in Bitcoin toward $150,000 creates a powerful opportunity for Bitcoin Cash. At minimum, he sees the potential for BCH to triple or quadruple. In a more aggressive scenario, he sees room for significantly more upside.

His blunt forecast: “2026: BCH 10X.”

Whether or not that exact number materializes, Chris’ core argument is that Bitcoin’s evolution into digital gold leaves room — and demand — for Bitcoin’s blockchain.

For his part, Paradigm’s chart hound Greg Guenthner asked: “Where’s the volatility?”

His answer: It’s coming. “We’re somewhere in the middle of the AI bubble,” Greg says. “That doesn’t mean it pops tomorrow. But it does mean the ride gets rougher.”

After years of relatively smooth upward momentum, he sees volatility returning in force — especially in the middle of 2026. Greg is watching Q2 and Q3 closely. A brewing malaise on Main Street and midterm election seasonality all point toward “volatility spikes.”

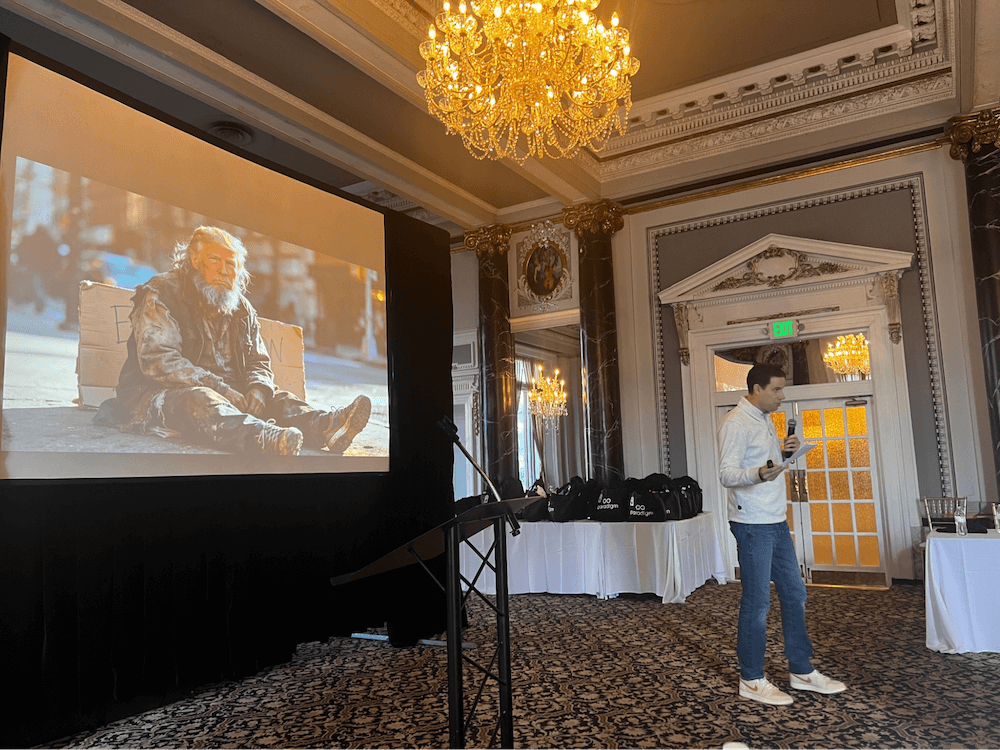

Greg Guenthner’s prize-winning presentation: “Polls look bad for Team Trump — Ohio and Iowa just flipped”

Greg highlights, in particular, structural changes at the Federal Reserve, noting a new Fed chair plus a shifting mandate could alter how markets price risk.

His bottom line for investors: “It’s about to get weird.” Stocks may still trend higher overall, but Greg doesn’t expect a straight line. Instead, he sees a target-rich environment — one where volatility creates opportunity for traders willing to stay flexible.

Bonus: Paradigm’s pro trader Enrique Abeyta reinforced Greg’s point with a history lesson. During the 1998 tech boom, he notes, the Nasdaq index suffered multiple corrections of 10% or more — driven by the Asian Financial Crisis and the LTCM collapse — even as it marched toward its eventual peak.

The lesson? Big secular bull markets don’t move in straight lines. They shake out weak hands first. And 2026, if our Baltimore summit is correct, will have plenty of thrills and spills.

Market Rundown for Wednesday, December 17, 2025

S&P 500 futures are up 0.15% to 6,865.

Oil’s down 1.80% to $56.25 for a barrel of WTI.

Gold is up 0.65% to $4,360 per ounce.

And Bitcoin is down 0.55% to $87,150.

P.S. Your editor today received an award at our Paradigm-wide all-hands meeting on Thursday. The official citation was something along the lines of “she’s always writing.” (Fair.) I received one of the gold statuettes you’ll see on the table below…

Paradigm’s VP of Publishing Doug Hill does his best Steve Jobs impersonation…

Even bigger kudos go to our in-house app wizard, Eric Mills, who took home the 2025 technology award — and who built the very app that lets you see what we’re writing the moment we hit “Publish.”

That’s the real magic of the FREE Paradigm Press app. No inbox lag. Just the ideas our editors are reading, reacting to and riffing on in real-time — delivered straight to you.

In a market where the Fed keeps guessing, geopolitics keeps shifting and “Did I miss something?” is a daily fear… this is your information upgrade. Plus, the Daily Feed signals what actually matters most.

If you’re reading this on your phone, download the free Paradigm Press app for iPhone or Android and check it out for yourself.

Trump's 2025 Report Card - Honest Grades

Posted December 22, 2025

By Matt Insley

I ❤️ Silver

Posted December 15, 2025

By Matt Insley

A Silver Bug Moment

Posted December 12, 2025

By Matt Insley

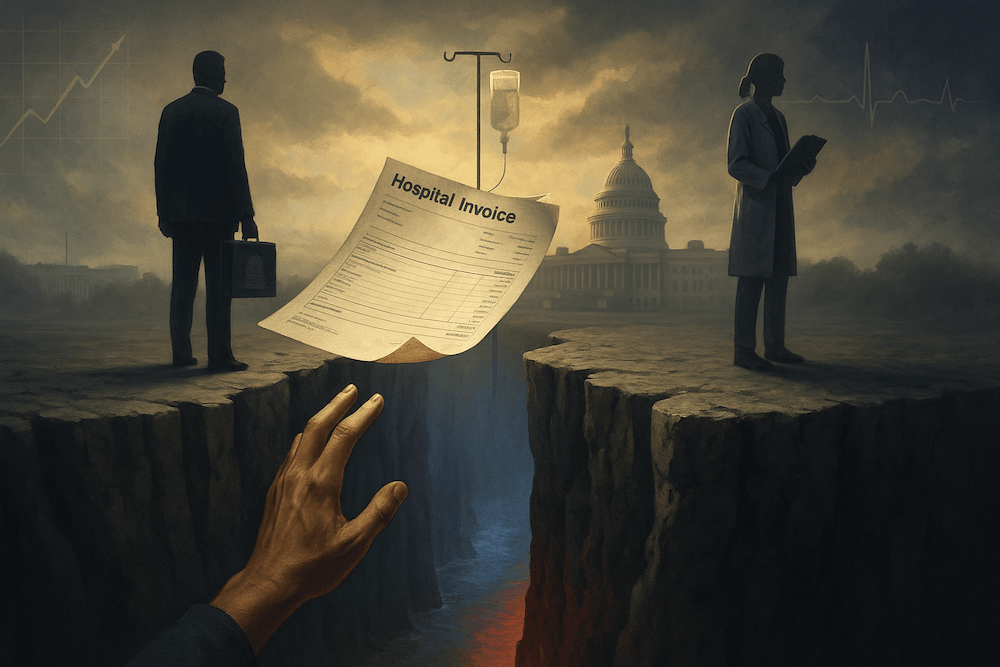

Obamacare Expiration

Posted December 10, 2025

By Matt Insley

Jim Rickards: The Truth About Gold

Posted December 08, 2025

By Matt Insley