Posted December 15, 2025

By Matt Insley

I ❤️ Silver

“I have $5,000… What should I buy and hold for the next 10 years?”

That was the question a friend put to Paradigm editor — and bleeding-edge crypto adopter — Chris Campbell in 2012.

“He was looking for something fun, off the beaten path. Edgy,” Chris recounts.

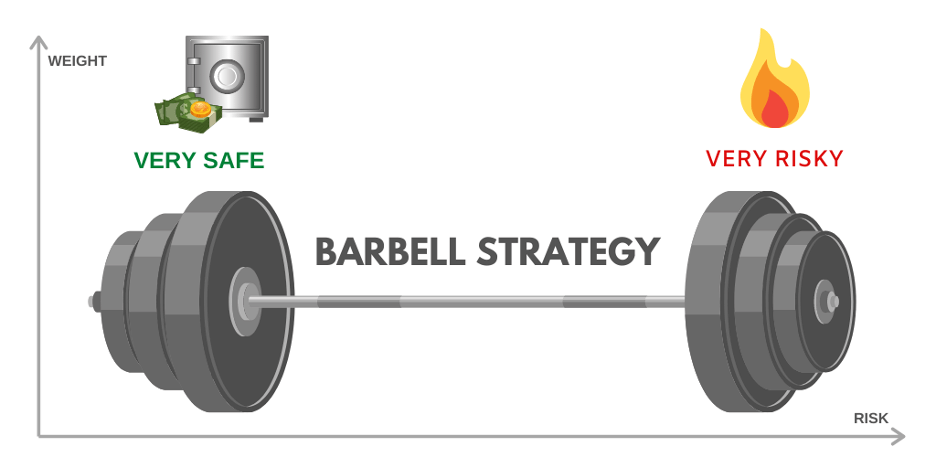

“I told him to get both silver and Bitcoin, a variation of the barbell strategy…

Source: Quantilia

“Silver was never going to zero. Odds are, it would eventually go up. Bitcoin could go to zero, but it could also go to $100,000 or more.

“He looked at me like I was a lunatic,” Chris recalls. “Bitcoin was around $100. There was no friggin’ way it would ever see $100,000.

“Also, in 2012, nobody in the financial media was talking about Bitcoin. If they were, they were talking about how it was a scam. EVERYONE was talking about silver.”

Chris continues: “My friend bought $5,000 worth of silver at $34 per ounce.

“Meanwhile, $2,500 in Bitcoin back then would be worth about $2.2 million today.” (Chris assures us his friend is doing just fine, despite the hard lesson learned.)

Today? Chris says his answer to the investment question put to him in 2012… would still be the same.

Your Rundown for Monday, December 15, 2025...

“I Still Love Silver”

“In recent months, I see an increasingly bullish case for silver,” says Chris.

“Executives from silver mining companies and analysts who follow the sector closely believe that silver is on the cusp of a major bull market, driven by a perfect storm of supply and demand factors.”

That forecast is no longer theoretical. Silver has broken out — clearing $61 an ounce for the first time since the early 1980s and outpacing gold, copper and oil.

Industrial users who once treated silver as abundant are now scrambling for supply. Refiners are paying any price. Defense contractors are whispering to suppliers that they’ll eat the overruns.

Silver’s four-year supply deficit has deepened, now exceeding 250 million ounces annually. “This structural shortage is the result of years of underinvestment in new mine supply,” says Chris, “coupled with rapidly growing demand from both industrial and investment sources.

“On the demand side, solar panel manufacturing has emerged as a major consumer of silver, accounting for around 35% of total demand(!).

“Some projections show solar demand rising to 50% of total silver consumption in the coming years — 50%!” he emphasizes.

“Add to that, investment demand for silver is also heating up, particularly in the key Asian markets of India and China.”

Why is this important? “Buyers in these countries,” says Chris, “have a clearer view of the supply/demand fundamentals than Western investors, prompting them to stock up on the metal.”

Meanwhile, silver’s industrial role has evolved from “secondary metal” to strategic resource. Modern weapons systems — radar, satellites, precision optics — all rely on it. And with global defense spending surging, procurement officers aren’t trading; they’re hoarding.

That helps explain today’s parabolic move. Precious metals dealers are reportedly under pressure as deliverable inventories shrink and lease rates soar. It’s not an orderly rally — it’s a race for real metal.

At the same time: “Resource nationalism in major silver-producing countries like Mexico, Peru and Chile is compounding the supply challenges,” Chris notes.

“Governments in these countries are looking to take a larger share of mining profits, while tighter regulations and social opposition are making it harder than ever to build new silver mines.”

All this, Chris believes, supports his near-term forecast: “My base case for silver,” he says, “it outperforms gold 4:1 in 2026.”

Because once silver clears key levels, miners tend to detonate, not drift. And years of underinvestment have left them coiled like springs.

Add in the monetary backdrop — central banks buying gold at record pace as the dollar’s dominance erodes — and silver’s direction seems clear.

“While often overlooked in favor of its yellow cousin,” Chris says, “silver’s moment in the spotlight may have finally arrived.

“I’ve heard it all before, of course,” he adds. “But I can’t help it… I still love silver.”

Market Rundown for Friday, December 15, 2025

S&P 500 futures are down 1% to 6,825.

Oil’s down 0.45% to $57.15 for a barrel of WTI.

Gold’s up 1.15% to $4,377.80 per ounce — and silver’s up 3.25% to $64.

Bitcoin’s up 1% to $89,500.

Trump's 2025 Report Card - Honest Grades

Posted December 22, 2025

By Matt Insley

Jim Rickards: How America Falls

Posted December 19, 2025

By Matt Insley

A Silver Bug Moment

Posted December 12, 2025

By Matt Insley

Obamacare Expiration

Posted December 10, 2025

By Matt Insley

Jim Rickards: The Truth About Gold

Posted December 08, 2025

By Matt Insley