Posted September 05, 2025

By Matt Insley

The American Birthright, Made Easy

Today we direct your attention to a recent piece from Chris Campbell at our sister publication, Altucher Confidential.

Chris’s argument for silver, as you’ll see below, connects perfectly with Jim Rickards’ American Birthright thesis.

Yes, rare earth elements (REE) are in a generational supply crunch. And yes, American innovation and independence depend on increased domestic production of rare earths.

But the vast trillions of dollars in wealth the American Birthright promises also includes gold, silver, platinum, uranium… The old school metals, the big uglies.

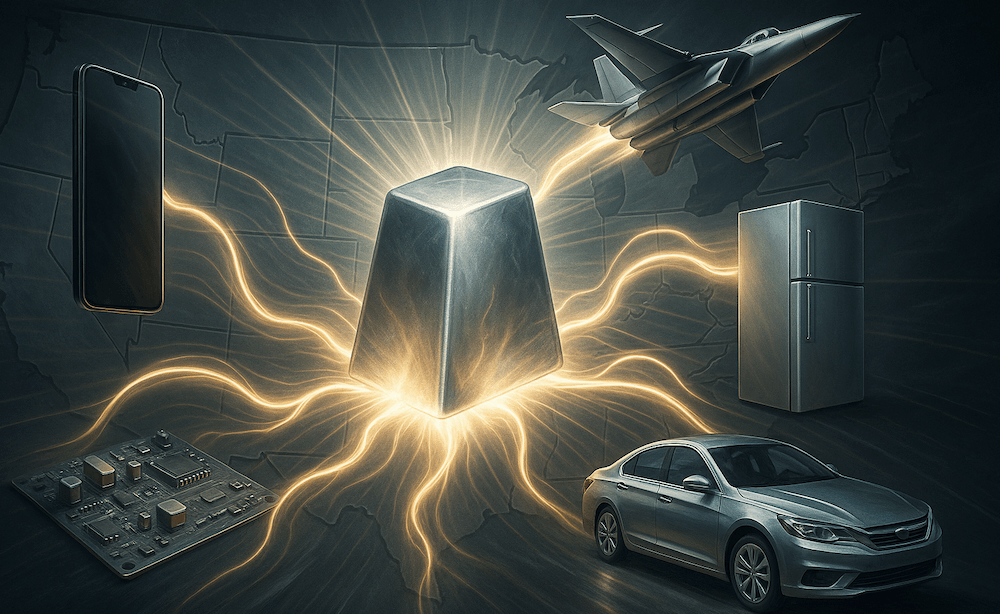

Silver, for example, touches tech, defense, household appliances, our cars and so on. Without it, there is no American economy.

America is rich. Rich in mineral and metal wealth. Our future depends on establishing the social and political will to tap into and utilize that wealth. Silver plays a part in that story.

The best part is, silver’s easy to buy so you can benefit along the way. It’s the American Birthright, made easy.

Chris Campbell’s here to explain why this could be a critical moment for silver…

Your Rundown for Friday, September 5, 2025...

Silver Makes Government “Critical Minerals” List

For the first time in history, the U.S. Department of the Interior has proposed adding silver to its Critical Minerals List in the draft version for 2025.

That means—at least in the government’s eyes—without silver, the American economy is vulnerable.

It’s not final yet. There’s a 30-day comment period before the list gets locked in. But the signal is already out there.

The world’s largest economy just labeled silver a potential national security risk if supply gets disrupted.

Should silver survive the draft and go critical?

The playbook is already written.

Uranium. Lithium. Both went vertical once Washington lit the fuse.

Let’s start with uranium…

After Fukushima in 2011, it was a dead asset—prices collapsed from $70 a pound to the $25 range, and it sat there for most of the 2010s.

But, in 2018, the U.S. quietly slipped uranium onto the Critical Minerals List. That one decision cracked the door.

By 2020, the Department of Energy was recommending a national uranium reserve.

By 2021, Congress funded it with seventy-five million dollars. By 2022, the Defense Production Act was in play to shore up the entire nuclear fuel supply chain.

Suddenly “cheap supply” wasn’t the mantra anymore. It was “secure supply.” Prices followed. From about thirty dollars a pound in 2020, uranium ripped past one hundred by 2024.

Lithium’s Story: Even More Dramatic.

In the mid-2010s, battery-grade lithium carbonate went for about seven thousand dollars a ton. Nobody outside of chemists and Tesla die-hards paid much attention.

Then in 2018 the U.S. put lithium on the Critical Minerals List. That stamp turned a niche chemical into a national priority.

Money rushed in.

Automakers inked long-term offtake deals. The Department of Energy opened its loan window. Later, the Inflation Reduction Act sweetened the pot with billions in subsidies for domestic battery supply chains.

By late 2022, lithium carbonate wasn’t $7,000 a ton anymore. It was EIGHTY thousand. A more than ten-fold spike.

Albemarle and SQM, once sleepy chemical producers, were suddenly market darlings. Juniors with nothing more than a claim and a press release raised capital overnight.

Even after the price cooled, lithium still trades at multiples of its pre-designation level.

And the designation didn’t just nudge lithium higher…

It rewired the entire supply chain.

Apples to Oranges?

Now look at silver.

It’s bigger than uranium and lithium combined.

BUT… bigger doesn’t mean harder to corner.

Silver has a much more fragmented supply chain and a chronic deficit—production can’t keep up with demand (1.16 billion ounces in 2024 vs. 820 million mined).

In fact, silver has run a deficit for the past four years straight. And the gap is widening, not shrinking.

Right now, above-ground stocks cover just two to three years of current demand (not accounting for any rise in demand), and much of that is locked away in ETFs and vaults.

Unlike gold, silver doesn’t sit idle.

It gets burned up in solar panels, EVs, semiconductors, and medical devices.

So what happens if the U.S. finalizes silver’s place on the critical list? History suggests the same pattern. But maybe even bigger.

Governments stockpile. Subsidies kick in. Investors wake up. Demand hits immediately, while supply takes years to respond.

That’s why uranium tripled and lithium went ten-fold.

And silver? With its dual role as both industrial backbone and monetary hedge, the setup could be even more violent.

Silver Shines

Washington doesn’t add minerals for fun.

It runs thousands of disruption models across industries—energy, defense, health, technology—and only elevates commodities where shortages could break the system.

Tech billionaire David Baitman recently took delivery of 12.7 million ounces —about 1.5% of annual global production.

One guy.

Saudi Arabia’s central bank disclosed a $40 million ETF position.

In most commodities, those figures are rounding errors. In silver, they matter.

Ultimately, silver doesn’t need Washington’s blessing to be scarce.

The designation just shines a spotlight on a fire already ablaze.

Market Rundown for Friday, September 5, 2025

S&P 500 futures are slightly in the green at 6,515.

Oil’s down 1.10%, just under $63 for a barrel of WTI.

Gold is up 0.55% to $3,625.90 per ounce.

Bitcoin’s up 2.50% to $112,660.

The Death of Charlie Kirk

Posted September 12, 2025

By Matt Insley

The Next 6–9 Months Could Get Ugly

Posted September 10, 2025

By Matt Insley

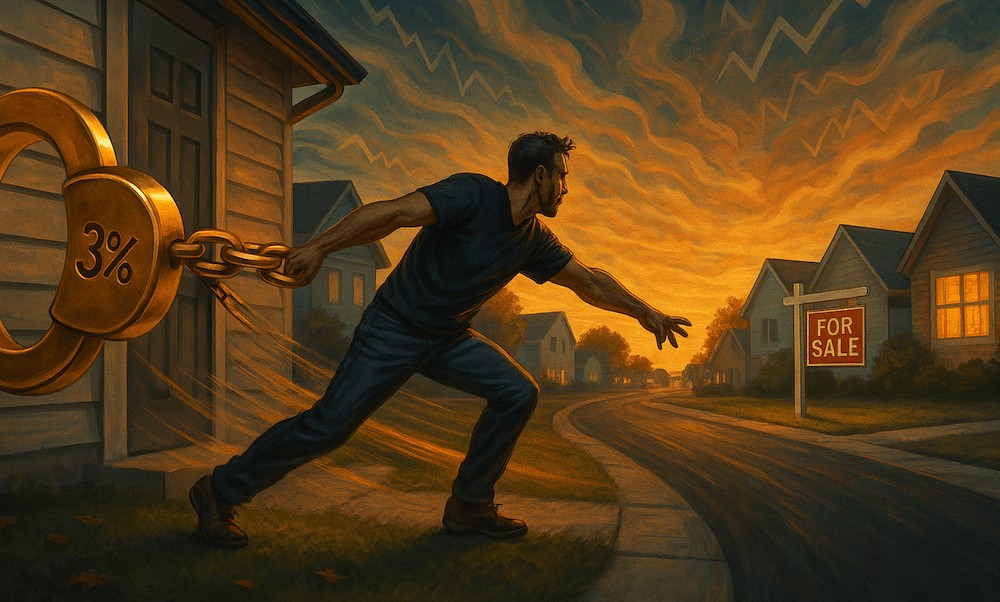

A National Housing Emergency

Posted September 03, 2025

By Matt Insley

![[MAHA] The Revolution D.C. Doesn’t Deserve](http://images.ctfassets.net/vha3zb1lo47k/6ElCQMyOgFL2Ar5pZgjswF/f887440099f1b694d813cdc7a06b2ada/run-issue-09-01-25-img-post.png)

[MAHA] The Revolution D.C. Doesn’t Deserve

Posted September 01, 2025

By Matt Insley

Your Sharpest Takes on America’s Future

Posted August 29, 2025

By Matt Insley