Posted September 10, 2025

By Matt Insley

The Next 6–9 Months Could Get Ugly

Inflation is the cloud overshadowing the American consumer — especially at the grocery store and gas pump. Most Americans feel the squeeze every time they check out at the supermarket or fill up the tank.

Even households with middle-class incomes are finding it increasingly difficult to maintain their standard of living in 2025, as rising costs for essentials continue to erode their purchasing power.

And judging by recent polling and economic data, there's now real reason to believe that inflation, especially for essentials like food and fuel, could worsen as we head into the 2026 election cycle.

President Trump campaigned in 2024 on the promise that “Americans are going to be affording their groceries very soon.” But nine months into his second term, price tags tell a very different story.

An August 2025 AP-NORC poll found that 53% of Americans say grocery expenses are a major source of stress — with only 14% feeling no stress at all about grocery costs.

Additionally, a Forbes feature highlights about 90% of Americans are worried about grocery costs. A Blue Yonder/Yahoo Finance survey and Pew Research Center also documented that food prices remain a top economic concern for two-thirds of U.S. adults.

While overall inflation has officially cooled from its post-pandemic peak, shoppers see little relief at the kitchen table. Eggs, beef, orange juice and other basics continue to surge — thanks to poor harvests, global supply hiccups and, yes, tariffs.

David Ortega, a food economist at Michigan State University, notes: “People’s budgets are strained. Everybody sees the price of food.”

The cost of a typical basket of groceries could easily jump again in the coming quarters, especially if more supply chain shocks hit. And as much as businesses try to absorb import costs or burn down inventories, those buffers are quickly evaporating.

Your Rundown for Wednesday, September 10, 2025...

Why Inflation Could Get Worse from Here

The picture at the pump is no less fraught. True, the average price hasn’t spiked to the $5 levels of the early ‘20s, but claims of a big drop are misleading. As of May 2025, the lowest average price for regular in the U.S. was $2.655/gallon in Mississippi, with most states significantly higher.

Forbes explains while gasoline prices have fallen compared to last year, they have actually climbed since January 2025 — a normal pattern during the summer driving season.

However, the real concern is that this year’s increase comes alongside underlying signs of economic weakness, which could mean that the rise in gas prices isn’t the result of growth, but rather deeper problems in the economy.

Critically, for millions of Americans who drive to work everyday, gasoline is not a luxury. And the price of gas acts as both a literal and psychological gauge of their budgets.

“Higher gas prices can lead to higher inflation across the board, affecting virtually every sector as transportation costs ripple throughout the supply chain,” Forbes Business Council warns.

This isn’t just theory: Past spikes in energy costs (like 2008 and 2022) have tipped the entire economy toward recession by crimping household spending.

What makes the next 6–9 months especially perilous? Three factors:

Tariffs and Trade Tensions: As the White House dials up tariffs, import costs are feeding directly into grocery and retail prices. Dozens of staples are caught as collateral damage.

Weather and Supply-Chain Shocks: Severe weather — drought, storms — has driven up prices for eggs, beef, juice and more. The global food system remains fragile.

Oil and Energy Markets: Any instability in the Middle East, OPEC cuts or refinery disruptions can quickly drive up U.S. fuel costs. Historically, energy shocks almost always presage broader inflation.

All these pressures have real-world consequences. As prices climb, the dollar’s purchasing power erodes — something Americans sense even if official numbers lag.

Recent decades offer clear precedents: the 1970s oil crisis, the stagflation years and, more recently, the 2008 and 2022 shocks, all produced similar consumer pain despite varied policy responses.

When goods and services cost more (especially food and fuel), holding cash becomes riskier by the month.

Already, professional money is shifting. As in the commodity supercycle of 2000–2011, money is starting to flow into mining, energy and basic materials — the sectors that benefit most when tangible assets outpace paper returns.

Simply put? If you’re feeling frustrated by rising prices, you’re not alone — and it’s not your imagination.

Government numbers, campaign promises and media narratives can’t hide the pain at the grocery checkout line or the gas pump. But don’t wait for policy makers to restore your buying power.

Now is the time to rethink how you hold your money. History shows that when inflation heats up and the dollar weakens, cash loses value while hard assets and critical resources gain ground.

The great rotations — 1970s into energy, 2000s into metals — weren’t just Wall Street trends; they were survival strategies. The next cycle of American prosperity may be built, once again, on the resources that keep the shelves stocked and the engines running.

Market Rundown for Wednesday, September 10, 2025

S&P 500 futures are up 0.30% to 6,540.

Oil is up 1.25% to $63.40 for a barrel of WTI.

Gold’s up 0.15% to $3,689 per ounce.

Bitcoin is up almost 2% to $113,400.

Taiwan’s Drone Dome

Posted September 08, 2025

By Matt Insley

The American Birthright, Made Easy

Posted September 05, 2025

By Matt Insley

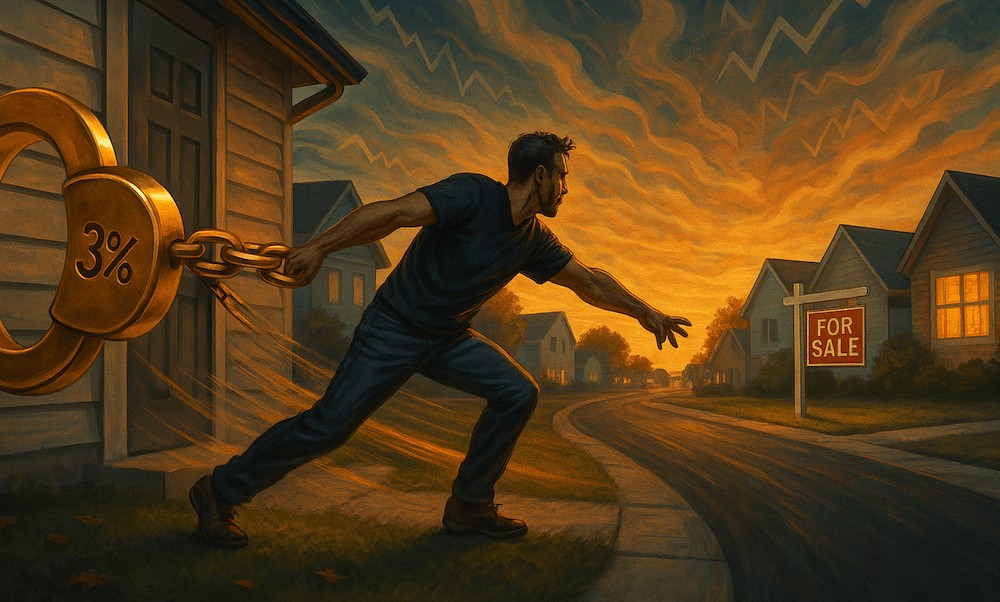

A National Housing Emergency

Posted September 03, 2025

By Matt Insley

![[MAHA] The Revolution D.C. Doesn’t Deserve](http://images.ctfassets.net/vha3zb1lo47k/6ElCQMyOgFL2Ar5pZgjswF/f887440099f1b694d813cdc7a06b2ada/run-issue-09-01-25-img-post.png)

[MAHA] The Revolution D.C. Doesn’t Deserve

Posted September 01, 2025

By Matt Insley

Your Sharpest Takes on America’s Future

Posted August 29, 2025

By Matt Insley